What is Insurance Verification in medical billing?

The healthcare industry provides medical care to thousands of people claiming to have healthcare insurance. It is because not everyone can afford the best treatments available in a hospital. However, many times people claiming to have health care insurance turn out to be frauds. Sometimes, they give wrong details about the insurance payer and avail medical care services at no cost. To prevent such false insurance claims hospitals make sure to get the insurance claim verified beforehand by outsourcing medical billing services. Medical billing is a service offered by medical billing companies to assist with various administrative tasks including verification.

Key Aspects of Insurance Verification

Insurance verification encompasses several crucial components that ensure its thoroughness and effectiveness:

- Coverage Status: Ensuring the coverage policy covers the precise clinical service the affected person requires.

- Active/Inactive Status: Verifying whether or not the insurance plan is active at the time of provider.

- Eligibility Status: Confirming the affected person’s eligibility to apply for the insurance plan for the supposed service.

Failure to address these components can also result in delays, revenue loss, or pointless administrative burdens for healthcare providers.

So, what is insurance verification in medical billing?

Insurance verification refers to the process of verifying insurance claims to avoid fraud or denials. The process requires a professional to contact the insurance company/payer to verify the insurance claims. The procedure of verifying the insurance claims focuses on three major aspects—coverage status, active/inactive status, and eligibility status. In addition to this Medical Insurance Verification Companies also help and keep track of account receivables. Not performing the verification thoroughly may result in the delay of payments.

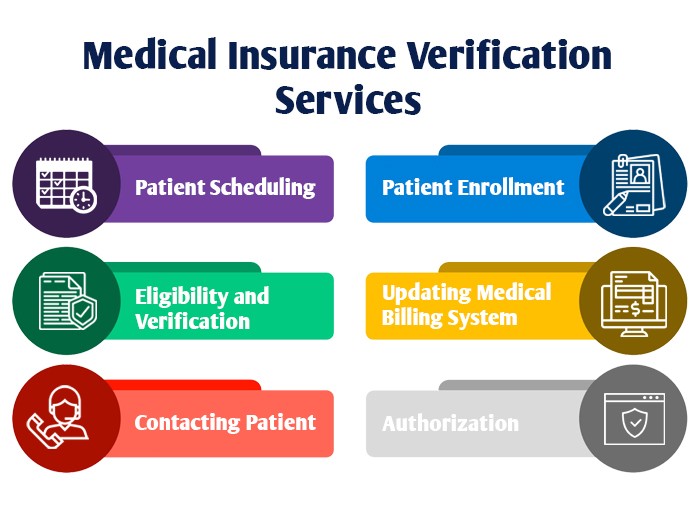

The insurance verification service offered by medical billing companies is quite trustworthy. Outsourcing insurance verification allows the hospital to prevent its revenue cycle from getting affected. The team of experts provided by the medical billing company follows the following steps.

- Patient Scheduling– Registering the patient by gathering his/her details like appointment via text, email, or fax. It helps in marinating a systematic record, and no long queues.

- Patient Enrollment– It is important to gather the patient’s demographic details. This helps in identifying the patient and maintaining his/her medical history. It also helps the hospital prevent insurance denials for the same information that can be used during insurance verification.

- Eligibility and Verification– The important procedure of cross-checking the details of an insurance claim is important to verify a patient’s eligibility for insurance.

- Authorization– It is essential to get the insurance company to authorize the insurance claim thus making it to pay the promised amount.

- Contacting Patient– It is important to update the patient about the status of the verification process.

- Updating Medical Billing System– The billing system is designed to keep a record of all the data associated with insurance verification.

Importance of Insurance Verification

Insurance verification performs a pivotal position in making sure a smooth healthcare journey for both patients and providers. The technique confirms that a patient’s insurance plan covers the offerings they may be searching for. By verifying coverage info earlier than rendering offerings, healthcare companies can:

- Prevent Revenue Loss: Verifying insurance coverage prevents situations wherein services are rendered without a guaranteed price.

- Minimize Claim Denials: Accurate coverage verification reduces the chance of claim denials because of discrepancies in insurance or eligibility.

- Enhance Patient Satisfaction: By confirming insurance upfront, sufferers are knowledgeable about their economic responsibilities, main to higher consideration and transparency.

Hospitals regularly outsource this project to specialized scientific billing groups, making ensure efficiency and accuracy inside the system. These businesses hire professional specialists who are properly versed in navigating insurance regulations and declare necessities.

How Outsourcing Insurance Verification Can Help You?

Many healthcare carriers choose to outsource coverage verification to specialized medical billing corporations. This technique offers several advantages:

- Expertise and Accuracy: Medical billing professionals are well-educated in insurance verification tactics, ensuring excessive accuracy and performance.

- Time Savings: By outsourcing this project, healthcare companies can recognition on turning in excellent care as opposed to handling administrative complexities.

- Improved Cash Flow: Timely verification and accurate billing lessen payment delays, ensuring a regular revenue flow.

- Cost-Effectiveness: Outsourcing gets rid of the need for in-house sources devoted to coverage verification, decreasing operational prices.

- Enhanced Compliance: Medical billing businesses stay updated with trendy insurance policies and regulations, minimizing the risk of non-compliance consequences.

Challenges in Insurance Verification

Despite its importance, coverage verification can be a hard procedure due to:

- High Volume of Claims: Managing huge volumes of coverage claims can weigh down in-house administrative groups.

Outsourcing to a professional medical billing organization enables mitigate these challenges efficiently.

Conclusion

Insurance verification is a cornerstone of green medical billing and sales cycle management. By making sure that insurance claims are correct and valid, healthcare companies can safeguard their sales even by handing over seamless care to patients. Outsourcing this manner to medical billing experts not handiest complements accuracy and efficiency but also permits carriers to focus on their middle assignment: enhancing affected person consequences.