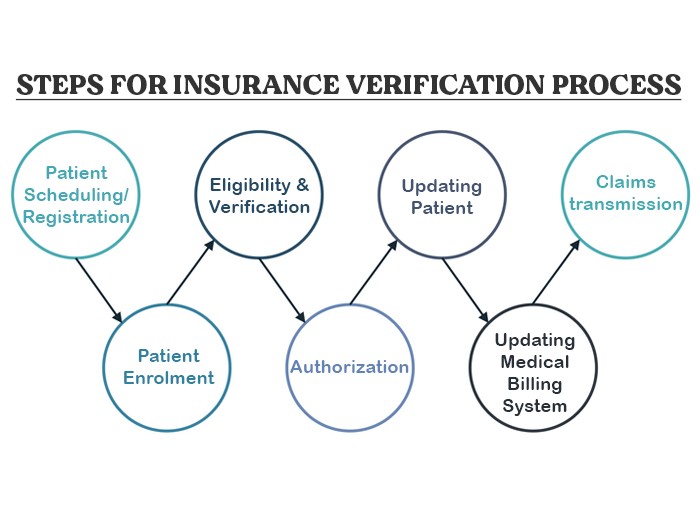

What is Insurance Verification Process

The coverage verification procedure is an important component of healthcare management, ensuring that sufferers’ insurance claims are dealt with efficiently and appropriately. This system at once affects the compensation of claims, which is a main factor in the economic fitness of medical institutions. Below, we delve deeper into the numerous stages of the coverage verification procedure, offering a complete expertise of its significance and capability.

Patient Scheduling/Registration

This process is referred to as patient scheduling or registration. The registration can be by opting for self-scheduling. The patient receives confirmation via email or phone text. Self-scheduling helps in making the process quick and streamlined. In case of emergencies, the registration can be done at the hospital itself.

Patient Enrolment

Demographic data is essential in insurance claims for it helps in identifying the patient. The demographic data may include details related to patient identification and medical history. The details like name date of birth, address, phone number, and email ID fall under patient identification. Whereas details like previous health issues, diagnoses, and /or treatments may fall under medical history. Moreover, additional information like emergency contact details, father’s name, insurance provider, etc. may also be recorded.

Eligibility and Verification

Insurance claims come with a risk of fraud. A lot of patients tend to make false insurance claims. Therefore, patient enrolment is not enough to prevent any fraud. As a precaution, hospitals must cross-check the insurance claims details provided by the patient.

Many healthcare facilities outsource this task to specialized medical insurance verification groups. These groups have the knowledge and gear to verify the authenticity of coverage claims quickly and efficaciously. Verifying eligibility at this degree prevents headaches later in the reimbursement method, saving time and assets for each patient and the healthcare provider.

Authorization

Insurance verification only establishes the eligibility of a patient’s insurance claim. However, it does not ensure that the insurance provider is obliged to pay the amount. This is where authorization steps in. It binds the insurance payer to authorize the claim by signing a document as a promise to pay a certain amount. This step is essential in avoiding denied claims and should not be overlooked.

Updating Patient

Clear communication with patients is a hallmark of a top-notch healthcare provider. During the coverage verification procedure, hospitals must promptly inform patients of any updates, modifications, or discrepancies determined. For instance, if positive treatments aren’t protected below the patient’s insurance plan or if additional documentation is needed, the patient has to be informed right now.

Updating Medical Billing System

Once the verification and authorization steps are complete, it is crucial to replace the clinical billing device. This step includes recording correct charge entries for services rendered, and ensuring that the billing gadget reflects the proven insurance info. An up-to-date billing gadget reduces errors at some stage in claim submission and hurries up the reimbursement procedure.

Healthcare providers rely on superior billing software to manage this step correctly, allowing seamless integration of proven insurance details with the patient’s medical information and billing data.

Claims transmission

The final step in the insurance verification method is claims transmission. This entails submitting the tested and licensed insurance claim to the insurance issuer for repayment. Electronic submission strategies are typically used, as they offer quicker processing times and reduce the likelihood of errors in comparison to manual submissions.

During claims transmission, healthcare providers make certain that all necessary documentation—such as affected person statistics, remedy information, and authorization bureaucracy—is covered. This step is critical for the timely compensation of claims, which without delay impacts the financial stability of the healthcare institution. By enforcing a robust coverage verification technique, healthcare facilities can decorate their operational performance, lessen administrative burdens, and improve patient pleasure.

Difficulties Faced in Insurance Verification

While the system is exceedingly simple, a few challenges can arise:

- Long Wait Times: Contacting insurance corporations by cellphone can often take a prolonged wait time.

- Inaccurate Information: Patients might also provide previous or wrong insurance information.

- Changes in Coverage: Insurance plans can trade, leading to discrepancies in insurance information.

The Role of Technology in Insurance Verification

Technology plays a substantial position in improving the performance of coverage verification. Electronic verification structures can automate many steps, along with:

- Batch Verification: Verifying multiple sufferers’ coverage simultaneously.

- Real-Time Verification: Checking coverage instantly at the factor of service.

- Eligibility Checks: Determining patient eligibility for specific offerings.

These systems lessen guide paintings, reduce mistakes, and accelerate the verification system.

Conclusion

The insurance verification technique is a multi-step method that calls for interest in detail and powerful communication between patients, healthcare companies, and insurance agencies. From patient scheduling and enrollment to eligibility tests, authorization, and claims transmission, each stage plays an important function in ensuring the clean processing of insurance claims.

By making an investment in superior tools and partnering with specialized verification groups, healthcare providers can streamline this method, lessen errors, and secure timely reimbursements. Ultimately, a well-performed insurance verification procedure contributes to the economic fitness of institutions and enhances the overall patient experience.